Decentralized identity marks a significant shift in the ways that both businesses and individuals handle personal data and identity verification.

The EU Digital Identity Wallet is an intriguing concept that’s closely tied to the evolving concept of decentralized identity. In addition to serving as the latest development in how individuals can verify their personal identities, decentralized identity will have a significant impact on financial institutions and fintech companies across the globe.

Before we dive into decentralized identity’s significance for businesses, let's explore its fundamental nuts and bolts.

Decentralized identity represents a rapidly growing framework within the digital identification and authentication landscape. Its innovative approach revolves around individuals having the ability to securely store and make use of their identity documents using digital wallets and blockchain technology. This, in turn, empowers individuals by giving them control over both their identity and personal data.

Centralized vs. Decentralized Identity

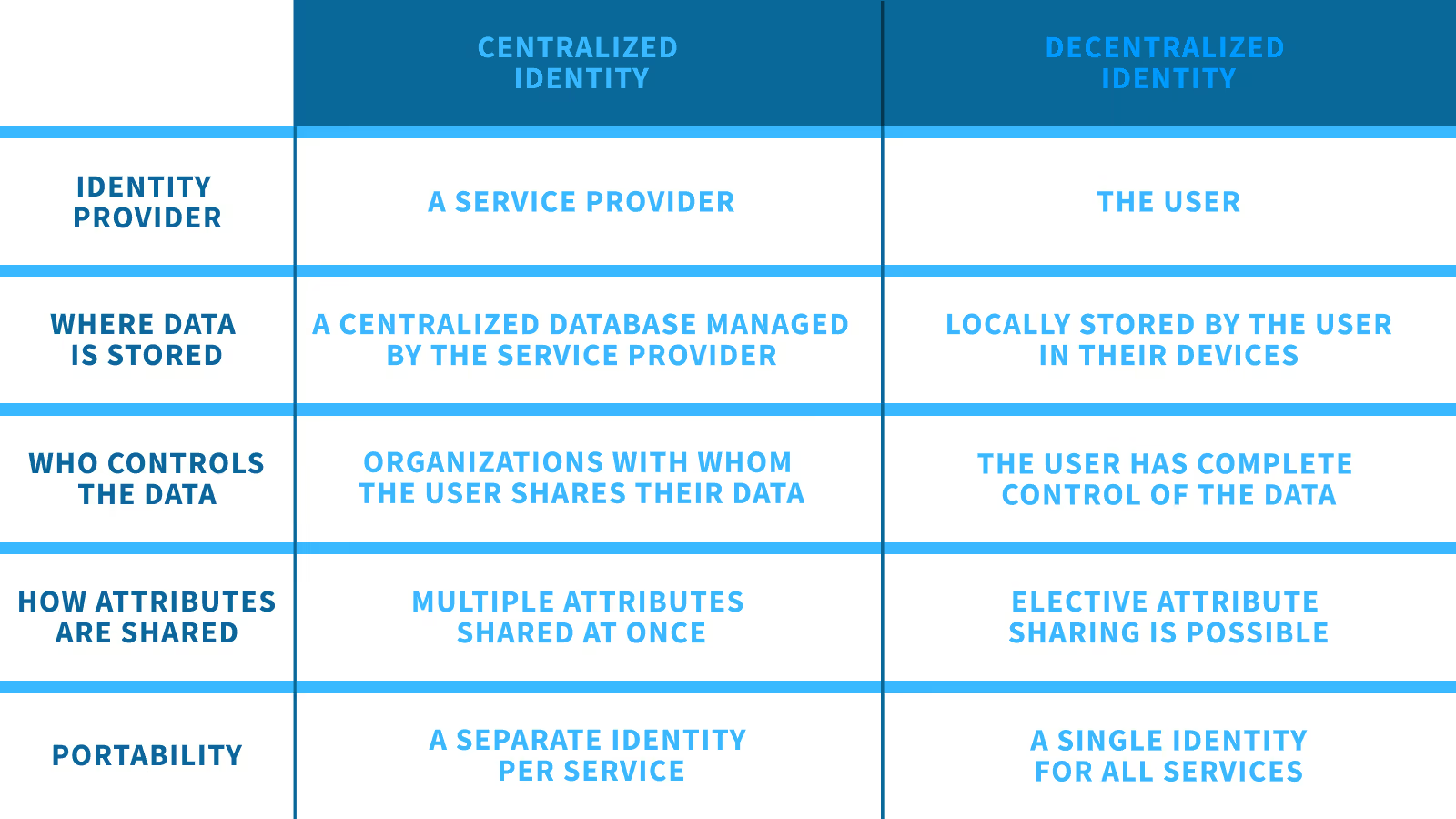

To form a complete picture of the impact delivered by decentralized identity, it’s important to understand the foundational distinctions between centralized and decentralized identity management.

In a centralized identity management system, data is stored and administered by a central authority or service provider. Typically, this entity maintains a centralized database where user identity information — like their full name, date of birth, address, email, and even financial information — is securely stored.

Conversely, decentralized identity utilizes digital wallets to allow users to securely store their own data. Their personal information goes through a cryptographic process to become issued as verifiable credentials (more on those in a bit!), which remain under their direct control at all times. This approach provides individuals with complete ownership and authority over their identity information, eliminating the need to rely on third-party intermediaries.

Furthermore, decentralized identity is designed to seamlessly straddle both online and offline domains. Whether it's through QR codes or NFC technology, this system is designed to make verifying one’s identity both a secure and straightforward process.

Here’s a direct comparison of centralized vs. decentralized identity management.

Roles in Decentralized Identity

At the core of decentralized identity is the concept known as the "triangle of trust”, which represents the relationships between three key roles: An issuer, holder, and verifier.

The functions that each of these roles carry out as well as how they interact can be described as follows:

- Issuer: The main role of issuers is to securely issue digitally signed ID documents to holders. A couple examples of issuers include government registries or identity providers.

- Holder: The holder is the user of an identity, and they can either be an individual or an organization. This role holds the signed ID documents received from issuers within their digital wallets, which typically take the form of a mobile application.

- Verifier: Verifiers are third-party entities or individuals that seek to validate a holder's identity.

How Do Decentralized Identifiers Work?

Since the early days of the internet, businesses and individuals have been using emails, usernames, and passwords to access websites, apps, and services — these can also be referred to as centralized identifiers.

Decentralized identifiers (DIDs), on the other hand, serve as a digital identification method that doesn’t require holders to give out their personal information. This is due to the fact that DIDs are created, owned, and managed completely by the holder without depending on any third party. DIDs are unique digital identifiers that are registered and stored on the blockchain.

The World Wide Web Consortium (W3C) has established the core architecture, data model, and representations of DIDs, which describes the technological standards that organizations creating DID solutions should follow. W3C describes DIDs as “a new type of identifier that enables verifiable, decentralized digital identity.”

Understanding Verifiable Credentials

As mentioned before, verifiable credentials are another core element of decentralized identity. A verifiable credential is a set of tamper-evident claims and metadata that cryptographically prove who issued it. In the words of the European Commission, “The Verifiable Credentials model allows verifiers to trust the data without needing to trust the source of it and to easily identify holders.”

DIDs have a close relationship with verifiable credentials: Simply put, holders use their DID to authenticate their identity when they request or share a verifiable credential. It’s important to note that, unlike DIDs, verifiable credentials aren’t stored on the blockchain.

Documents that can be issued as verifiable credentials include both physical ones (such as a personal ID, driver’s license, university diploma, or a travel document) and digital assets (the ownership of a bank account). Because these documents’ attributes can generally vary, they can’t be considered fully secure without an issuer’s signature. Once the issuer signs the identity claim (or a set of identity claims), the documents become verifiable credentials.

What Decentralized Identity Means for Financial Institutions

Decentralized identity marks a significant shift in the ways that both businesses and individuals handle personal data and identity verification. The standards and the technologies related to decentralized identity are both exciting and quite fresh. At this time, its related systems and technologies remain under construction.

So what can your business do today to get prepared? In addition to becoming better acquainted with the concepts and standards related to decentralized identity, now’s the perfect time to begin thinking about practical next steps that you can take to help implement the EU Digital Identity Wallet into your ecosystem.

Here’s how to get started:

- Begin designing processes for onboarding via the EU Digital Identity Wallet

- Build a business case (KYC cost reduction; customer attribute sharing)

- Perform internal pilots with moderate resources

- Stay informed on your country’s legislation timeline

.webp)